Introduction

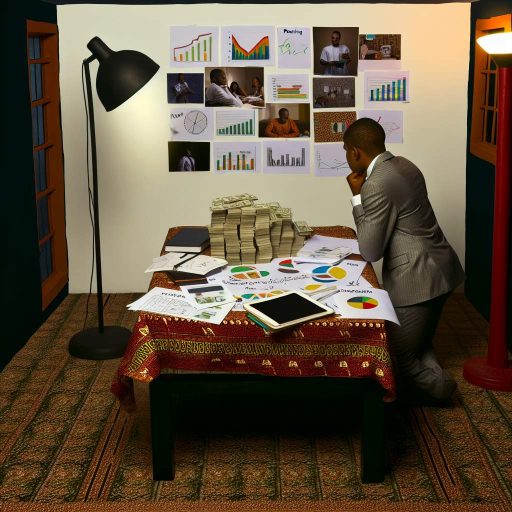

Finance plays a crucial role in the entrepreneurial journey.

It fuels growth, supports innovation, and sustains operations.

Without proper financial management, startups can face significant challenges.

These challenges are even more pronounced for Nigerian startups.

Nigeria’s startup ecosystem is vibrant, yet unique.

Entrepreneurs often struggle with limited access to funding.

Many investors hesitate due to perceived risks in the Nigerian market.

Additionally, navigating regulations and bureaucratic hurdles complicates financial planning.

Currency fluctuations further exacerbate financial challenges for startups.

Despite these hurdles, many Nigerian entrepreneurs find innovative solutions.

They adapt by leveraging local resources and technology.

They embrace creativity in budgeting and financial forecasting.

Understanding financial strategies becomes imperative for survival.

This blog post aims to unveil entrepreneurial finance secrets specifically for Nigerian startups.

We will explore practical tips, strategies, and local funding opportunities.

Our approach will empower entrepreneurs to make informed financial decisions.

By addressing the unique obstacles faced by Nigerian businesses, we hope to enhance their chances of success.

Join us as we delve into essential financial insights.

Learn how to manage finances effectively while growing your startup.

Whether you’re a budding entrepreneur or seasoned business leader, these insights will guide you.

Let’s embark on this journey to unlock financial success for Nigeria’s vibrant startups.

Understanding the Financial Landscape in Nigeria

Overview of the Current State of the Nigerian Economy

Nigeria boasts Africa’s largest economy, driven by diverse sectors.

The economy continues to face several challenges.

However, it shows potential for growth and innovation.

Inflation rates remain high, affecting buying power and investment.

The unemployment rate worsens each year, creating further urgencies for new businesses.

Despite these challenges, Nigeria’s startup ecosystem is vibrant.

Tech-driven platforms and digital services lead the way.

According to recent statistics, the technology sector attracts considerable investment.

Fintech startups, in particular, demonstrate robust growth.

They fill gaps in the financial services landscape, creating ripple effects across sectors.

With increasing internet penetration, more Nigerians embrace digital solutions.

Online marketplaces, e-commerce, and SaaS platforms emerge rapidly.

However, startups must navigate economic volatility.

They often grapple with issues like currency fluctuations and regulatory uncertainties.

The Availability of Financial Institutions and Funding Sources

Nigerian startups benefit from a variety of financial institutions.

Traditional banks, microfinance banks, and development finance institutions offer funding.

Also, these institutions provide necessary resources for budding entrepreneurs.

Here’s a list of prominent funding sources available to Nigerian startups:

- Commercial Banks: They offer loans, credit facilities, and overdrafts.

- Microfinance Banks: They cater to small businesses with less stringent requirements.

- Venture Capital Firms: They invest in high-potential startups, offering mentorship.

- Angel Investors: They are affluent individuals who provide capital and advice.

- Government Grants: Various government initiatives support entrepreneurship with grants.

- Incubators and Accelerators: They provide funding, mentorship, and networking opportunities.

- Crowdfunding Platforms: They allow startups to raise funds from a large audience.

These institutions support startups at various stages.

Yet, many entrepreneurs struggle to access these funds.

The complexity of application processes creates additional challenges.

Startup founders often lack proper financial documentation.

This lack of preparedness can hinder funding opportunities.

Examination of Common Financial Barriers Faced by Startups in Nigeria

Nigerian startups encounter numerous financial barriers.

Understanding these challenges is crucial for overcoming them.

Here are some common financial barriers faced by entrepreneurs:

- Lack of Collateral: Many startups cannot provide sufficient collateral for loans.

- High Interest Rates: Borrowing costs can be prohibitive for early-stage startups.

- Complex Regulatory Environment: Navigating regulations can distract from focus on growth.

- Limited Financial Literacy: Many entrepreneurs lack knowledge of finance management.

- Market Volatility: Changes in the economic environment can affect business operations.

- Inconsistent Revenue Streams: Many startups struggle with generating steady income.

- Risk of Fraud: Startups face the constant risk of financial fraud.

These barriers create significant hurdles for aspiring entrepreneurs.

They can stifle innovation and growth potential.

Yet, with proactive measures, startups can surmount these challenges.

Building strong relationships with financial institutions can bolster funding access.

Understanding financial statements, projections, and budgets is essential.

Workshops and online courses can enhance financial skills.

Additionally, mentorship from experienced entrepreneurs can guide them through financial hurdles.

Investors increasingly look for businesses with sound financial practices.

Startups that demonstrate transparency attract more interest.

They should keep detailed records and regularly review financial health.

This practice builds trust with potential investors and financial institutions.

Networking remains crucial in the entrepreneurial journey.

Connections with other entrepreneurs, investors, and business leaders provide resources.

A strong network offers advice, connections, and sometimes funding.

Platforms like LinkedIn can help in finding relevant contacts in the industry.

In fact, navigating the financial landscape in Nigeria presents challenges.

However, startups that understand these complexities can thrive.

They must leverage available resources and maintain financial discipline.

With effort and determination, they can overcome barriers to achieve growth and success.

As the economy continues to evolve, the potential for innovation remains endless.

Entrepreneurs are encouraged to embrace their journey and push boundaries.

Sources of Financing for Nigerian Entrepreneurs

Financing is crucial for startups in Nigeria.

Entrepreneurs often seek various sources to get their business ideas off the ground.

Understanding available funding options enhances the chances of success.

Below is a detailed analysis of different financing sources for Nigerian entrepreneurs.

Traditional Funding Options

Nigerian entrepreneurs traditionally rely on banks and credit unions for financing.

These institutions offer structured loans that can support business growth.

Bank Loans

Bank loans are one of the most common funding sources.

They enable entrepreneurs to access substantial amounts of capital.

However, entrepreneurs must meet stringent requirements.

- Credit Score: A good credit score is essential for qualifying.

- Collateral: Banks often require collateral to secure the loan.

- Business Plan: A detailed business plan is necessary.

- Repayment Terms: Understanding the repayment schedule is vital.

Many banks offer specific loans designed for small businesses.

Entrepreneurs can explore loans from institutions like Zenith Bank, GTBank, and Access Bank.

These banks often provide tailored financing solutions.

Credit Unions

Credit unions present another traditional funding option.

They often have lower interest rates than banks.

This makes them an appealing choice for startups.

- Membership: Entrepreneurs must become members of the credit union.

- Community Focus: Many credit unions focus on community development.

- Personal Relationship: Building a relationship can increase chances of loan approval.

Essentially, credit unions are more personal and flexible than banks.

They can offer smaller loans, suitable for startups at the initial stage.

Alternative Financing

While traditional funding sources are crucial, alternative financing is gaining popularity.

Startups often seek alternative routes when traditional funding proves insufficient.

Angel Investors

Angel investors are affluent individuals who provide capital.

They often invest in startups in exchange for equity or convertible debt.

Finding angel investors requires networking and relationship building.

- Investment Amounts: Angel investors typically invest between $25,000 to $250,000.

- Mentorship: Many angel investors offer business mentorship.

- Less Stringent Requirements: Requirements are often more relaxed than banks.

Networking platforms such as Social Media and LinkedIn can help in finding angel investors.

Angel investment networks, like Lagos Angel Network, also provide support for entrepreneurs.

Venture Capital

Venture capital (VC) firms specialize in funding early-stage companies.

These firms typically invest large sums of money.

They expect high returns on investment.

- Equity Stake: Startups usually give up a percentage of equity.

- Due Diligence: VCs perform extensive due diligence before investing.

- Mentorship: VCs often provide guidance and industry expertise.

Reputable VC firms in Nigeria include GreenHouse Capital and EchoVC Partners.

Startups should approach these firms with a solid business model to attract investment.

Government Grants and Loans

Government grants and loans play an essential role in financing startups.

They provide funds that entrepreneurs do not need to repay.

However, accessing these funds requires meeting specific criteria.

Government Grants

Grants offer non-repayable financial support to eligible startups.

Various government programs aim to stimulate entrepreneurship in Nigeria.

- Youth Enterprise with Innovation in Nigeria (YEWIN): This program supports young entrepreneurs.

- Bank of Industry (BoI): Offers loans and grants for small enterprises.

- National Information Technology Development Agency (NITDA): Provides funding for technology-focused startups.

Grants usually demand a detailed proposal and project outline.

Entrepreneurs must showcase how their initiatives will create jobs and promote economic growth.

Government Loans

Government loans offer accessible financing options.

These loans typically come with lower interest rates.

- Anchor Borrowers’ Program: Supports agricultural startups.

- SME Fund: Designed for small and medium enterprises.

- Trade & Employment Program: Supports businesses focused on trade and employment.

To qualify for government loans, entrepreneurs must meet specific eligibility criteria.

Providing legitimate documents and a business plan is critical for approval.

Nigerian entrepreneurs have access to various financing options.

Traditional banking products and credit unions remain foundational sources of capital.

Furthermore, angel investors and venture capitalists provide growth opportunities.

Additionally, governmental support through grants and loans fosters innovation and entrepreneurship.

Understanding and exploring these funding avenues is essential for startup success in Nigeria.

Entrepreneurs should conduct thorough research and assess their options.

The right financing can turn an innovative idea into a thriving business.

Read: Why Every Nigerian Entrepreneur Should Understand Finance

Developing a Solid Business Plan

In the vibrant landscape of Nigerian startups, a well-structured business plan stands as a crucial foundation.

Entrepreneurs aiming for success must understand its importance in securing funding.

A compelling business plan not only attracts investors but also guides the business’s future trajectory.

Here’s how to craft an effective business plan specific to the Nigerian market.

Importance of a Well-Structured Business Plan

A solid business plan plays several key roles in the entrepreneurial ecosystem:

- Attracts Investors: A detailed plan showcases your business’s potential, drawing interest from investors.

- Defines Vision: It articulates your business goals, ensuring everyone is aligned on the mission.

- Identifies Opportunities: A business plan helps identify market gaps, guiding you towards lucrative opportunities.

- Establishes Credibility: A professional plan establishes your credibility, enhancing your business’s image.

- Facilitates Management: It serves as a roadmap for managing resources and tracking progress.

- Aids in Risk Assessment: Identifying potential risks boosts your preparedness for challenges ahead.

Key Components of an Effective Business Plan

When crafting a business plan, certain components are particularly vital for the Nigerian market:

- Executive Summary: This section summarizes your business and highlights key points.

It should capture the reader’s attention immediately. - Company Description: Clearly define your business’s mission, vision, and values.

Describe your industry and market position. - Market Analysis: Conduct thorough research on your target market.

Understand your customers and competitors.

Include statistics and trends specific to Nigeria. - Marketing Strategy: Outline how you plan to reach your target audience.

Detail your branding, promotion, and distribution strategies. - Organization and Management: Present your business structure.

Introduce your team and their qualifications.

Highlight relevant experience and expertise. - Product Line or Services: Describe your products or services.

Focus on their unique features and benefits.

Explain how they solve problems for customers. - Funding Request: Specify how much funding you need and how you plan to use it.

Break down projected expenses clearly. - Financial Projections: Provide realistic financial forecasts.

Include income statements, cash flow statements, and balance sheets for at least three years. - Appendix: Include any additional documents that support your business plan.

This may include charts, resumes, or legal agreements.

Tips for Presenting a Business Plan to Potential Investors

Once you’ve created your business plan, effectively presenting it becomes vital.

Here are tips to engage potential investors:

- Be Clear and Concise: Use simple language.

Avoid jargon and focus on essential information. - Practice Your Pitch: Rehearse your presentation multiple times.

Familiarity boosts your confidence and clarity. - Engage with Visuals: Use visual aids, like slides or charts.

Visuals can help illustrate your points clearly. - Tailor to Your Audience: Understand your investors’ interests.

Customize your presentation to their preferences and concerns. - Highlight Your Team: Emphasize the experience and skills of your team.

Investors often invest in people, not just ideas. - Showcase Market Knowledge: Demonstrate your understanding of the Nigerian market.

Knowledge of local dynamics reassures investors. - Prepare for Questions: Anticipate potential questions from investors.

Address likely concerns before they arise. - Be Passionate: Express your enthusiasm for the business.

Your passion can inspire confidence in your venture. - Follow Up: After your presentation, send a thank-you note.

This establishes a positive rapport and keeps the communication channel open.

Building a startup in Nigeria requires careful planning and execution.

A well-structured business plan can significantly enhance your chances of securing funding.

By focusing on essential components and effectively presenting your plan, you position your business for future success.

Ultimately, your business plan becomes a living document, guiding your entrepreneurial journey in a dynamic market.

With dedication and strategic planning, your startup can thrive in Nigeria’s ever-evolving landscape.

Read: Career Paths in Corporate Finance: Nigeria’s Landscape

Cash Flow Management Tips

Understanding Cash Flow

Cash flow refers to the movement of money in and out of a business.

It is critical for maintaining daily operations.

For startups, managing cash flow effectively can mean the difference between success and failure.

Positive cash flow signifies that a company has enough liquid assets to cover its obligations.

Conversely, negative cash flow indicates financial struggles.

Startups often face unique challenges that can hinder their cash flow.

Recognizing these challenges early can help entrepreneurs take preventative measures.

Significance of Cash Flow for Startups

Cash flow plays a vital role in operational stability.

Here are some reasons why cash flow management is significant:

- Operational Expenses: Startups require sufficient cash flow to pay salaries, rent, and utilities.

- Investment Opportunities: A strong cash position allows startups to seize new business opportunities.

- Crisis Management: Good cash flow equips startups to handle unexpected financial challenges.

- Investor Confidence: Investors often seek startups with solid cash flow management practices.

- Growth Potential: A healthy cash flow supports reinvestment for expansion and development.

Strategies for Effective Cash Flow Forecasting and Management

Effective cash flow forecasting assists startups in anticipating their financial needs.

Implementing the following strategies can enhance cash flow management:

- Create a Cash Flow Statement: Regularly prepare a cash flow statement to track inflows and outflows.

This helps in identifying trends. - Implement a Budget: Establish a budget that outlines income and expenses.

This allows for better control over finances. - Monitor Cash Flow Regularly: Conduct weekly or monthly reviews of cash flow statements.

Early detection of discrepancies helps mitigate risks. - Use Cash Flow Management Software: Leverage technology to automate tracking and forecasting.

Tools like QuickBooks or Airtable can simplify processes. - Establish Payment Terms: Set clear payment terms with clients.

Encourage early payments by offering discounts or incentives. - Maintain a Cash Reserve: Create a cash reserve to cover short-term expenses.

This serves as a financial buffer during lean periods. - Reduce Overheads: Regularly assess expenses and cut unnecessary costs.

This improves cash flow and increases profitability. - Diversify Revenue Streams: Explore multiple income sources.

This diversification reduces reliance on a single revenue stream.

Common Cash Flow Pitfalls to Avoid

Many startups fall into common cash flow traps.

Being aware of these pitfalls can prevent financial distress:

- Lack of Financial Planning: Failing to plan finances properly leads to overspending and unanticipated shortfalls.

- Inefficient Billing Processes: Inefficient invoicing or billing systems delay payments and negatively impact cash flow.

- Overestimating Revenue: Being overly optimistic about anticipated income can lead to cash shortfalls.

- Poor Inventory Management: Excess inventory ties up capital that could otherwise be used to cover expenses.

- Neglecting Taxes: Ignoring tax obligations can result in late fees and increased financial strain.

- Not Tracking Receivables: Failing to monitor accounts receivable allows debts to pile up, draining cash flow.

- Lack of Communication with Suppliers: Poor supplier relationships can negatively impact terms and increase costs.

- Ignoring Seasonal Trends: Many businesses experience seasonal fluctuations, impacting cash flow. Plan accordingly.

Implementing Cash Flow Management Practices

Startups can adopt various practices to improve cash flow management:

- Prioritize Cash Flow: Always prioritize cash flow over profits in the early stages.

Ensure liquidity before pursuing profit. - Establish Clear Credit Policies: Define credit terms for customers and stick to them.

This reduces the risk of late payments. - Encourage Prompt Payments: Offer discounts for early payments.

This can motivate clients to pay invoices quickly. - Offer Prepayment Discounts: Encourage clients to pay upfront by offering attractive discounts.

This boosts available cash. - Utilize Lines of Credit: Consider establishing lines of credit with financial institutions.

This provides quick access to funds as needed. - Identify Key Performance Indicators: Track KPIs relevant to cash flow, such as days sales outstanding.

These metrics inform strategic decisions. - Regular Training for Staff: Educate staff on cash flow importance and best practices.

An informed team can help maintain cash flow.

Cash flow management remains a cornerstone of startup success in Nigeria.

By understanding the essentials of cash flow, startups can implement effective strategies.

Awareness of pitfalls empowers entrepreneurs to avoid common financial traps.

As Nigerian startups navigate their journey, proactive cash flow management will enhance their chances of sustainable growth.

Ultimately, controlling cash flow leads to a resilient business ready to flourish in the competitive market.

Read: Trends in Corporate Finance: Nigeria’s Growth Catalyst

Leveraging Technology for Financial Management

Overview of Financial Management Software and Tools Suitable for Nigerian Startups

In today’s fast-paced business environment, financial management is critical for startups.

Nigerian startups benefit immensely from adopting the right financial management software.

These tools simplify budgeting, tracking expenses, and generating financial reports.

Here, we explore several popular tools suitable for Nigerian startups:

- Tally ERP 9: A popular accounting software that supports invoicing and inventory management.

- Sage One: Cloud-based accounting software ideal for small businesses.

- QuickBooks: Effective for expense tracking, invoicing, and generating financial statements.

- Xero: Provides an intuitive interface for invoicing and bank reconciliation.

- Zoho Books: Ideal for automating workflows and managing finances efficiently.

By leveraging these tools, Nigerian startups can enhance financial accuracy and streamline operations.

Automation reduces manual errors, thus ensuring smarter financial decisions.

Importance of Digital Banking and Online Financial Services

Digital banking and online financial services are transforming the financial landscape in Nigeria.

Startups must embrace these innovations for better management and growth.

Here’s why digital banking is crucial:

- Accessibility: Startups can manage finances anywhere, anytime with mobile banking apps.

- Cost-Effectiveness: Low transaction fees save money for startups.

- Faster Transactions: Instant transfers and payments speed up cash flow.

- Enhanced Security: Digital banking offers secure transactions through encryption.

- Integration: Seamless integration with financial management tools simplifies processes.

Nigerian startups must leverage these benefits to optimize their financial operations.

A robust digital banking system can provide crucial support during challenging times.

Financial managers can focus on strategic planning when financial processes are efficient.

Case Studies of Nigerian Startups Successfully Using Technology for Financial Management

Nigerian startups have successfully employed technology for financial management.

Here are notable examples:

Paystack

Paystack has revolutionized payments in Nigeria.

By automating payment processing, Paystack reduces the complexities involved in managing transactions.

The company integrates seamlessly with accounting software.

This integration allows for real-time tracking and reconciliation of financial transactions.

Flutterwave

Flutterwave offers an end-to-end payment solution for businesses.

Their platform enables startups to accept payments easily.

By using Flutterwave, startups can automate financial reporting.

This automation helps identify trends and improve decision-making.

Cowrywise

Cowrywise has simplified investment management for Nigerians.

Their platform allows users to manage investments digitally.

Startups benefit from Cowrywise’s budgeting tools, allowing for effective financial planning.

Nigerian startups show that integrating financial technology enhances operational efficiency.

Successful case studies inspire others to adopt similar strategies.

For startups, leveraging these technologies can provide a financial edge in the competitive market.

In summary, leveraging technology for financial management is essential for Nigerian startups.

Financial management software and tools simplify complex processes.

Digital banking improves accessibility and reduces costs.

Successful case studies demonstrate the positive impact technology can have on financial management.

For Nigerian startups, adopting these strategies can lead to financial success.

When startups invest in proper financial management, they lay a strong foundation for growth.

Technology is not just an option; it is a necessity for modern financial management.

Read: The Crucial Role of Corporate Finance in Job Creation

Building Relationships with Investors and Financial Institutions

Building relationships with investors and financial institutions is crucial for Nigerian startups.

Networking can lead to significant opportunities.

A strong relationship with financial stakeholders can enhance your startup’s credibility.

It is essential to explore strategies to cultivate these invaluable connections.

Strategies for Networking

Networking is an art that requires strategy and effort.

Here are key strategies to build connections:

- Attend Industry Events: Participate in conferences, seminars, and workshops.

These gatherings provide excellent networking opportunities.

Engage with potential investors and partners face-to-face. - Join Professional Associations: Become a member of relevant industry associations.

These groups often facilitate networking events.

Participate actively to forge meaningful relationships. - Utilize Social Media: Use platforms like LinkedIn to connect with investors and institutions.

Share valuable content to position yourself as an industry leader.

Respond to comments and engage with your audience regularly. - Leverage Existing Networks: Tap into your current connections.

Ask for introductions to investors or financial institutions.

A warm introduction often carries more weight. - Be Proactive: Don’t wait for opportunities to come to you.

Reach out to potential investors with personalized messages.

Express your interest in their work and provide insights into your business.

The Role of Transparency and Communication

Transparency and communication are critical components of building investor relations.

Startups should prioritize these areas to instill trust and confidence.

- Regular Updates: Keep your investors informed with frequent updates.

Share progress reports on your operations and financial status.

This practice showcases your dedication to transparency. - Open Communication Channels: Foster an environment where investors feel comfortable during discussions.

Encourage them to ask questions and share concerns.

Actively listen and address their issues. - Be Honest About Challenges: Don’t shy away from discussing potential roadblocks.

Share your challenges frankly and outline your action plans.

Investors appreciate honesty and are more likely to offer support. - Clarify Expectations: Ensure that both parties understand their roles and responsibilities.

Create a mutual understanding of what each expects from the relationship.

This clarity reduces misunderstandings. - Solicit Feedback: Regularly ask for feedback from investors.

This shows you value their opinions and strengthens your relationship.

Use their suggestions to improve your operations.

Tips for Maintaining Lasting Partnerships

Maintaining lasting partnerships with financial stakeholders requires dedication and effort.

Here are effective tips to nurture these important relationships:

- Deliver on Promises: Always meet the commitments you make to investors.

Consistently deliver results that align with your proposals.

Reliability fosters trust and strengthens relationships. - Celebrate Successes Together: Share your achievements with your investors.

Acknowledge their contributions to your success.

Hosting events or sending personalized messages during milestones can help. - Maintain Professionalism: Treat your investors with respect and professionalism.

Address issues promptly, and communicate openly.

A strong sense of professionalism enhances your reputation. - Engage in Joint Ventures: Look for opportunities to collaborate on projects.

Joint ventures can tap into additional resources and expertise.

They show your commitment to creating mutual value. - Be Adaptable: The financial landscape is constantly evolving.

Stay adaptable to the changing environment.

Adjust your strategies to meet the needs of your investors and market conditions. - Provide Value-Added Insights: Share market trends, insights, and valuable information with your investors.

Providing them valuable knowledge keeps them engaged.

It positions you as a thought leader in your industry.

In a nutshell, building relationships with investors and financial institutions is essential for Nigerian startups.

Effective networking involves strategic actions and maintaining transparency.

By prioritizing engagement and communication, you can cultivate lasting partnerships.

These relationships will empower your startup with the resources needed for growth.

Commit to building a strong network today, and watch your business thrive in the competitive landscape.

Scaling Your Startup with Sustainable Financial Practices

Understanding the Importance of Sustainability in Financial Practices

Sustainable financial practices play a crucial role for startups.

These practices ensure long-term viability and growth.

In the dynamic environment of Nigerian entrepreneurship, sustainability becomes even more relevant.

It allows businesses to thrive amidst economic challenges.

Startups that adopt sustainable financial strategies often find themselves better positioned.

They can make informed decisions that lead to continued growth.

Sustainable practices include prudent budgeting, responsible investing, and ethical profit generation.

Moreover, sustainable practices often resonate with consumers.

Modern consumers prefer supporting companies that demonstrate social responsibility.

Therefore, startups need to integrate sustainability into their financial practices.

This alignment can enhance brand loyalty and drive sales.

Strategies for Scaling a Business While Maintaining Financial Health

Scaling a startup requires careful planning and execution.

Here are several effective strategies startups can employ:

- Implement Lean Operations: Startups must focus on minimizing waste and maximizing efficiency.

They should continually assess their operations for cost-saving opportunities. - Prioritize Cash Flow Management: Strong cash flow is essential for growth.

Startups should monitor inflows and outflows diligently and implement effective cash management systems. - Diversify Revenue Streams: Relying on a single source of income can be risky.

Startups should explore new markets and products to spread revenue sources. - Invest in Technology: Technology can enhance operational efficiency.

Startups should adopt the latest tools to automate processes and reduce labor costs. - Build Strategic Partnerships: Collaborating with other businesses can open new opportunities.

Partnerships can provide access to resources and networks that would otherwise be unavailable. - Monitor Key Performance Indicators: Startups must track their financial health.

Monitoring KPIs helps identify trends and areas needing improvement. - Seek Professional Guidance: Engaging financial advisors can provide essential insights.

Professionals can guide startups in scaling effectively while maintaining financial sanity.

By incorporating these strategies, startups can better manage their finances while scaling.

The focus should remain on sustainability, ensuring long-term success without overspending or risking financial instability.

Examples of Nigerian Startups Successfully Scaling Through Strategic Financial Practices

Many Nigerian startups have achieved remarkable growth through strategic financial practices.

Here are a few noteworthy examples:

- Flutterwave: This fintech startup facilitates seamless payment solutions across Africa.

Its successful scaling involved diversifying revenue streams through partnerships with various e-commerce platforms. - Paystack: Another fintech giant, Paystack emphasizes cash flow management.

Their strategic focus on technology investment allowed them to handle a growing customer base with fewer resources. - Jumia: Known as the “Amazon of Africa,” Jumia has scaled aggressively.

Its success lies in implementing lean operations and prioritizing customer satisfaction, which enhances repeat business. - Andela: Specializing in training software developers, Andela emphasizes sustainability.

They focus on building a talent pipeline, ensuring long-term growth while maintaining quality. - Terrapay: This startup offers cross-border payment solutions.

Their sustainable financial practices revolve around strategic partnerships, which have propelled their expansion across Africa.

Each of these startups showcases the importance of thoughtful financial practices.

They leverage sustainability as a core part of their scaling strategies, ensuring they grow responsibly.

Scaling a startup in Nigeria requires a well-thought-out approach.

Entrepreneurs must focus on sustainable financial practices to achieve their goals.

By doing so, they can maintain financial health while navigating the complexities of growth.

Implementing strategies such as cash flow management, technology investment, and partnerships creates a strong foundation for scaling.

Furthermore, learning from successful Nigerian startups can provide valuable insights into best practices.

Ultimately, sustainability in financial practices empowers startups.

It allows them to build resilient businesses capable of weathering future challenges.

In the end, these practices not only foster growth but also contribute positively to society.

Conclusion

In this blog post, we explored key financial strategies for Nigerian startups.

We emphasized the importance of financial planning and budgeting.

Entrepreneurs should create a detailed financial plan to guide their operations.

Understanding cash flow is crucial for maintaining financial health.

Always monitor expenses and revenue to make informed decisions.

We discussed the significance of securing funding.

Entrepreneurs must seek out grants, loans, or investments.

Building relationships with investors can lead to immense opportunities.

Networking often opens doors to potential capital sources.

Additionally, we highlighted the value of financial literacy.

Entrepreneurs must educate themselves on financial concepts.

Knowledge about accounting and cash management can drive business success.

Strong financial management mitigates risks and maximizes growth potential.

Encouragingly, we noted that successful startups often prioritize financial discipline.

Implementing the financial secrets outlined can foster sustainable growth.

Focus on profitability and operational efficiency to achieve long-term success.

In general, we urge Nigerian entrepreneurs to adopt these financial strategies.

The journey of entrepreneurship is fraught with challenges, but proper financial management can pave the way for success.

The future of startups in Nigeria looks promising.

A robust financial foundation can lead to innovation and economic growth.

The potential impact of disciplined financial practices is immense.

Strong financial management can drive startups to reach their full potential.

By implementing these strategies, entrepreneurs not only enhance their prospects but also contribute to Nigeria’s economic development.

As you embark on your entrepreneurial journey, remember that financial management is key.

Equip yourself with the knowledge and skills to thrive.

The road ahead may be challenging, but the rewards of successful entrepreneurship are worth the effort.